New to KPERS?

We're Glad You're Here!

Let us help you get off on the right foot.

We're Not Just Retirement.

KPERS isn’t just about retirement. We help protect your income while you’re still working … with disability benefits, death benefits and life insurance. Then when you’re eligible, you’ll get a monthly retirement benefit for life. It may seem like a long way off, but it’ll be here faster than you think.

There are a few things you should do now to get off on the right foot. Don't worry. Most of them are pretty easy.

4 Big Things That Make a Difference.

- Set up your online account. It'll only take a few minutes.

- Name beneficiaries in your online account.

- Learn a little about your benefits, so you know what's what should you need them.

- Save more on your own, because KPERS won't be enough. More about that later.

You Pay In.

But It'll Be Worth It.

If you haven't noticed already, your membership is automatic. It starts with your first paycheck.

You make pretax contributions from your pay. Your employer also contributes to help fund the System. KPERS invests the money throughout your career so there is enough to pay you a retirement benefit for life. KPERS’ investments kick in about 50% of our funding.

What Kind of Member Are You?

Your benefits depend on what type of member you are. Most new members are KPERS 3. Watch this video for a quick look at your benefits. If you're a KP&F member, you can watch your video here. Generally speaking, there are 5 groups of members.

- KPERS 1

Hired Before July 1, 2009 - KPERS 2

July 1, 2009 - Dec. 31, 2014 - KPERS 3

Hired Jan. 1, 2015 and After - KP&F

Kansas Police & Fire, EMTs - Judges

Elected & Appointed Judges

KPERS & Social Security Won't Be Enough.

Having additional savings gives you some cushion to pay monthly expenses and for the occasional "surprise." And it helps you fight inflation. The price of just about everything goes up from year to year. Think how expensive it will be in 30 years.

And the sooner you start, the more time your money has to grow. That can pay off big in retirement thanks to the power of compound interest.

Where to Save

One of the easiest ways to save is through an optional employer plan, like a 457 or 403b. Check with Human Resources at your employer for options where you work. You could also consider opening your own individual retirement account (IRA) if that works better for you.

It doesn't really matter where you save, as long as you are savings. Your future self will thank you!

The Easy Option

All State agencies and many local employers offer KPERS 457, an optional deferred compensation plan. With KPERS 457, you choose how much to save and can get started with as little as $12 a paycheck. All State employees can participate. If you work for a local employer like a county or city, see if your employer offers KPERS 457 (PDF).

Basic Info

You'll your enter name, date of birth and Social Security number.

Email Address

You can use any email address.

It'll be your login ID.

You can change it anytime in your account.

Password

Password must contain:

- 12+ characters

- At least 3 of the 4: uppercase letter, lowercase letter, number, special character

Image & Phrase

Select an image and enter a phrase. This will display each time you login.

Security Questions

You'll pick 3 security questions in case you forget your password.

In Your Account

- See membership info like your balance and service

- Add or change beneficiaries

- Get a personalized retirement benefit estimate

- See your annual statement

- Update your contact info

KPERS is a prefunded system (not like Social Security). The Trust Fund is made up of contributions from members and employers, plus investment income over time. Funds are invested now to pay benefits down the road.

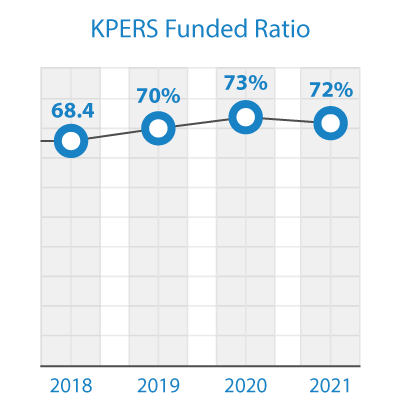

Most members have heard news coverage about KPERS’ long-term funding shortfall. The not-so-good news is KPERS does have a long-term funding shortfall. The great news is we’ve made progress! KPERS is on the right path and headed in the right direction.

Check out our Funding page for a high-level snapshot of KPERS' current funding status.

For a deeper dive, click here to watch a recording of our "KPERS Funding Basics" webinar. Link opens in a new window.