Revised:

11/20

Frequently Viewed

If You Have Questions

- [email protected]

- 1-888-275-5737

- 785-296-6166

Quick Vids

KPERS Retirees who return to work for a KPERS employer are subject to working-after-retirement rules, which are different from active-member rules.

KPERS retirees don't have an earnings limit or make member contributions. The employer contribution rate increases from the regular statutory rate to 30% when a retired employee's wages top $25,000.

The law states that KPERS employers and their employees cannot make prearrangements (anytime before retirement or during the waiting period after retirement) to return to work.

The statutory definition of a prearrangement states that a prearrangement occurs when the “facts and circumstances of the situation indicate that the employer and employee reasonably anticipated that further services would be performed after the employee’s retirement.”

The statutory definition of a prearrangement states that a prearrangement occurs when the “facts and circumstances of the situation indicate that the employer and employee reasonably anticipated that further services would be performed after the employee’s retirement.”

Written or verbal communication is not allowed. Consider it a period of silence.

Both employees (on retirement application) and employers (when hiring a KPERS retiree) must certify they have not made prearrangments to return to work.

Employee

On the KPERS retirement application, employees certify that the prearrangement rule has been and will be followed (before retirement and during the waiting period after the retirement date).

Employer

When hiring a retiree, the employer's appointing authority will need to certify there have been no prearrangements on the Employer Certification of No Prearranged Employment (KPERS-15R-E) form.

Appointing Authority

| Schools | district superintendent

(if retiree being hired is superintendent, school board president must certify) |

|---|---|

| Local | chief officer of governing body

(e.g., city manager, mayor, commission/council chair) |

| State | agency head |

KPERS' "Qualified Status" with the IRS could be jeopardized if employees and/or employers don't follow the no-prearrangement rule. They'll also be penalized.

Employee Penalties

- Retirement benefit suspended starting month returned to work and ending 6 months after ending employment

- Repay KPERS all monthly retirement benefits paid to employee after he began working after retirement

Employer Penalties

- Pay all IRS-associated costs and penalties

- Pay all costs for legal defense

- Pay all costs for collecting repayment from employee

Retirees have a waiting period before they can return to work for a KPERS-affiliated employer. The waiting period starts the day after their retirement date.

- Retire before age 62 = 180 days

- Retire age 62 or after = 60 days

To calculate the waiting period, count the day after retirement as day one.

Generally, enroll all KPERS retirees who work for your employer, even those in non-covered positions like part-time, temporary or seasonal positions and report their wages. If an employee is not a KPERS retiree (the enrollment look up will tell you), enroll them as an active member.

Exceptions (Do Not Enroll)

Still must follow "no-prearrangement" and waiting-period rules

- Election poll workers

- Sub teachers without a contract

- Legislative staff

- Positions covered by KBOR Mandatory Retirement Plan

- STARBASE employees

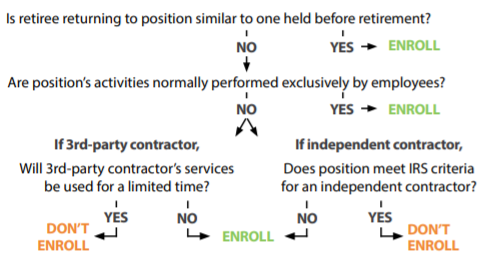

Enroll or Don't Enroll (3rd-party and independent contractors)

Employees working after retirement do not pay contributions.

Employers generally do pay the statutory contribution rate based on wages of covered employees. Check out specific employer rates on the contribution page.

| Positon Types | Covered Positions1 | Non-Covered Positions2 |

| Earnings Limit | No Limit | No Limit |

| Employer Contributions | Up to $25,000 earnings: Statutory Rate Above $25,000 earnings: 30%* |

No Contributions (still enroll and report wages) $25,000 rate threshold does not apply to non-covered positions |

1. Not seasonal/temporary and requires at least 1,000 hours (630 for schools) per year

2. Seasonal/temporary and requires less than 1,000 (630 for schools) per year

* The system tracks wages for you and automatically changes the rate when needed. The rate change to 30% starts with the first pay period after the employee reaches $25,000 in the calendar year for both school and non-school employers.