Revised:

1/22

Frequently Viewed

If You Have Questions

- [email protected]

- 1-888-275-5737

- 785-296-6166

Related Quick Vids

- The Kansas Board of Regents Office

- Emporia State University (ESU)

- Fort Hays State University (FHSU)

- Kansas State University (KSU)

- Pittsburg State University (PSU)

- University of Kansas in Lawrence (KU)

- University of Kansas Medical Center in Kansas City (KUMC)

- Wichita State University (WSU)

The Kansas Legislature formed KPERS in 1962, providing retirement benefits to all state employees, with one exception. KBOR employers, instead, contracted with the Teacher Insurance and Annuity Association-College Retirement Equities Fund (TIAA-CREF, now known as TIAA). The resulting KBOR Mandatory Retirement Plan (KBOR Plan) gave Regent faculty state-to-state portability, a feature not available with KPERS.

New Employees

Classified (University Support Staff) KPERS

Employees hired at Regents institutions in classified, benefits-eligible positions become KPERS members.

Employer Manual: KPERS membership

Unclassified KBOR

Employees hired at Regents institutions in unclassified, benefits-eligible positions (faculty and some professional staff) become KBOR Plan members, after meeting the required one year of employment.

State employees hired at Regents institutions in unclassified, benefits-eligible positions may elect to stay at KPERS or move to the KBOR Retirement Plan.

By law, employees can’t contribute to both the KPERS and KBOR Mandatory Plans at the same time. They can, however, contribute to KPERS and the KBOR Voluntary Plan at the same time.

- If KPERS member moves to KBOR-eligible position or

- KBOR Plan member moves to KPERS-eligible position

- Must choose whether to stay in current plan

The member must complete the Retirement Plan Election for Kansas Board of Regents Employees form (KPERS-3BOR). The employer certifies.

If a KPERS-3BOR form is not submitted, the employee will default to the plan tied to the new position.

What happens to the KPERS account?

If a KPERS member who is working at a Regent institution transfers to the KBOR Plan with the same employer or becomes ineligible for KPERS because of reduced hours at the same employer, his KPERS account will continue to draw interest as long as he remains with the same employer (Regent institutions and The State of Kansas are considered the same employer).

| Group | KPERS service before transfer | Accrue interest? | For how long? | Then what? | Retirement eligibility |

|---|---|---|---|---|---|

| KPERS 1 | 1 yr | Yes | Until leaves employer | Can withdraw if leaves employer Can retire from KPERS |

65 w/ 1-yr |

| KPERS 2 | 1 yr | Yes | Until leaves employer | Can withdraw if leaves employer |

65 w/ 5-yrs |

| KPERS 3 | 1 yr | Yes | Until leaves employer | Can withdraw if leaves employer |

65 w/ 5-yrs |

If the member transfers from the KBOR employer to a KPERS employer, his KPERS membership and regular vesting period picks up where it left off.

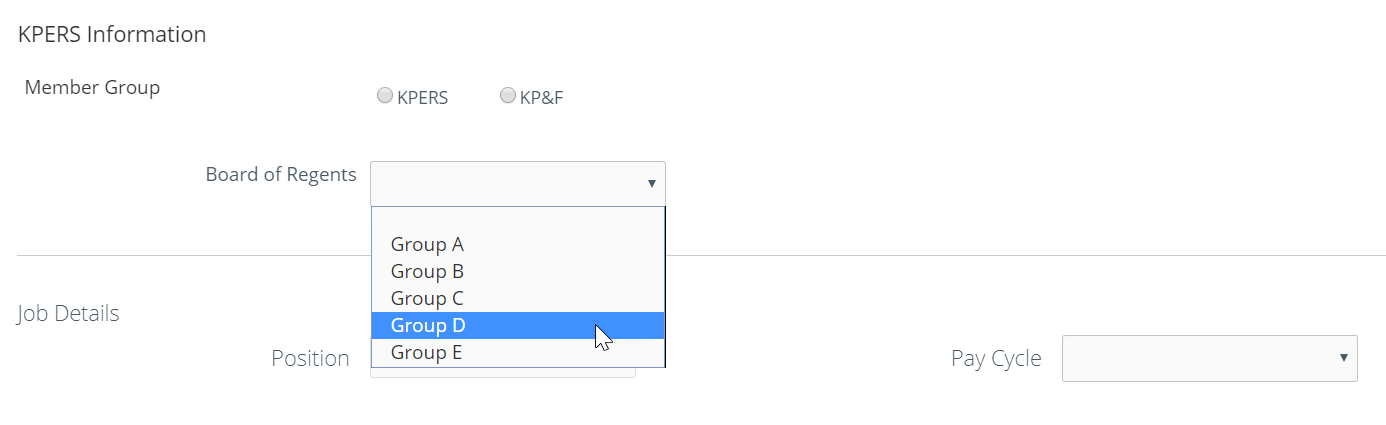

When enrolling employees, you must enter the group they belong to.

This is for KBOR Plan members who are prior-service only members of KPERS. They have service as faculty and/or unclassified employee at a Regents institution before January 1, 1962, which counts as KPERS prior service.

- University reports current KBOR salary to KPERS.

- KPERS benefit is based on higher of KBOR salary or KPERS salary.

- Member may use KBOR service to help meet retirement eligibility with KPERS.

KBOR Plan members who are inactive KPERS members with some “participating service” in KPERS. KBOR Plan start date is before July 1, 1998.

- University reports current KBOR salary to KPERS.

- KPERS benefit is based on higher of KBOR salary or KPERS salary.

- Member may use KBOR service to help meet retirement eligibility with KPERS.

KBOR Plan members who are inactive KPERS members with some “participating service” in KPERS. KBOR Plan start date is on or after July 1, 1998.

- University does not report current KBOR salary to KPERS.

- KPERS benefit is calculated using KPERS salary only.

- Member may not use KBOR service to help meet retirement eligibility with KPERS.

Active KPERS members who are working at a KBOR employer but are not eligible for or are not participating in the KBOR Plan.

- University reports KPERS-covered wages to KPERS.

- KPERS benefit is calculated using KPERS salary only.

- Member may not use KBOR service to help meet retirement eligibility with KPERS.

Employee working at a Board of Regents employer but is neither a KPERS member nor has any KPERS service. Employer does not enroll member using the EWP. KPERS will not know who is a Group E with your employer

- University does not report KBOR salary to KPERS.

- No KPERS benefit can be calculated.

If an active KPERS member (or a KBOR member with an inactive KPERS account) dies, KPERS provides his beneficiaries with a lump-sum payment of the member’s KPERS contributions and interest. Beneficiaries may also receive life-insurance payments.

Effective January 1, 2022, KPERS life insurance benefits include occupational assault and accidental death and disability coverage. Exclusions apply. For full details, see the Optional Life Insurance brochure and Certificate of Insurance.

Instead of receiving the members contributions and interest, a surviving spouse of a member may choose a lifetime monthly benefit.

- Member's spouse must be only primary beneficiary

- If member is eligible to retire at time of death, spouse begins receiving monthly benefit immediately

- If member is not eligible to retire at time of death, but has at least 10 years of service credit, the spouse receives monthly benefit at earliest time member would have been eligible for regular or early retirement

KPERS 3 Specifics: If member is not eligible to retire at time of death, but has at least 5 years of service credit, the spouse receives monthly benefit at earliest time member would have been eligible for full/normal retirement.

Accelerated Death Benefit

If an employee is diagnosed with a terminal illness with 24 months or fewer to live, he may be eligible to receive up to 100% of his life insurance while he is still living, instead of going to his beneficiaries after he dies.

Job-related

If an employee dies from an on-the-job accident, his spouse receives 50% of his final average salary paid in a monthly benefit (less Workers’ Compensation/$100 minimum) and a $50,000 lump-sum payment. This is in addition to returned contributions, plus interest, and life insurance.

Basic

Employees in covered positions automatically receive employer-paid basic life insurance coverage equal to 150% of their annual salary, regardless of their plan.

Basic Life Insurance: Employer Manual (Life insurance & Death)

Optional Life Insurance: Employer Manual

Optional

Employees in covered positions can choose to purchase optional life insurance, regardless of their plan. They can get coverage for themselves, spouses and/or dependent children.

To communicate how they want life insurance and death benefits paid, employees need to designate a beneficiary through their online account* or with the Designation of Beneficiary paper form (KPERS-7/99A).

*Members with KBOR service only do not have a KPERS online account and must submit a KPERS-7/99A, which is kept by their employer in their personnel file.

Benefits a Beneficiary Receives

- Basic life insurance (150% of employee's annual salary

- Any optional life insurance

- Returned KPERS account balance or possible a monthly benefit for spouse

Who Can You Name as Beneficiary?

- A living person

- A trust

- The employee's estate

- Any combination of these options

Note:

- If an employee chooses more than one beneficiary, each will share the benefit equally.

- Employees can name life insurance beneficiaries that are the same as or different from retirement-benefit beneficiaries.

Employees in both the KPERS and the KBOR are covered by KPERS long-term disability insurance. This coverage provides financial protection by replacing part of the employee’s income if he becomes disabled by injury or sickness for a long time.

Disability coverage is not available while an employee is on military leave.

Basic Life Insurance: Employer Manual (Life insurance & Death)

Position NOT Covered by KBOR Plan, Follow KPERS Rules

A KPERS retiree who goes to work for a KBOR employer in a position not covered by the KBOR Mandatory Retirement Plan, must follow all of the KPERS working-after-retirement rules.

Working After Retirement: (Working After Retirement Web Page)

Position Covered by KBOR Plan, Exempt from KPERS Rules

A KPERS retiree who goes to work for a KBOR employer in positions covered by the KBOR Mandatory Retirement Plan are exempt from the KPERS working-after-retirement rules. Do not enroll them in the KPERS Working After Retirement Plan.

If you hire a KBOR Plan retiree into a position covered by the KBOR Plan, consult the working-after-retirement rules for the KBOR Plan.